Incentive Up to 10 years for new companies and up to 5 years for expansion projects 100 exemption is provided from the year they start generating statutory income. Management and control is the key factor used to ascertain the residence status of a company in Malaysia.

Audit Exemption For Private Companies Venture Haven Top Malaysia Accounting Firm

Investment holding company 60 FA.

. The company has lodged its latest Annual Return and Audited Financial Statements or its latest Exempt Private Company EPC certificate. Weve helped companies run over 85 successful funding. 220 one-time fee A fully Private Label Tea design is completely original and will be uniquely yours.

Chargeable income of life fund subject to tax 60 B. The information be accessed via SSM e-Info portal at httpswwwssm. Obtaining a medical report from a private hospital or clinic.

1 A private company shall appoint an auditor for each financial year of the company. Please forward application using companys letterhead to. Choose from our curated list of growth companies.

Similarly where the vehicle is held for the private use of a shareholder or associate of a private company there may be an exposure to deemed Division 7A Div7A assessable dividends. Raised for private companies and PEVC funds. Work with us to create tailored shares liquidity programmes for your company and employees and stay in control of your cap table.

Reduced rate and exempt dividend 60 AA. HEMPTEA THC-Free Imported Cannabinoid-Infused CBD Loose Tea. If you have.

Pengarah Lembaga Hasil Dalam Negeri Malaysia Jabatan Pungutan Hasil Aras 15 Menara Hasil Persiaran Rimba Permai Cyber 8 Peti Surat 11833 63000 Cyberjaya Selangor Darul Ehsan Attn. Sign up Learn more. Trade private company shares.

Gas and tolls Parking. Dividend paid by a resident company of a contracting state to a resident of the other contracting state may be taxed in that other state. We can match your current branding or design something new.

600 Number of deals launched. Therefore it may be advantageous to use a Malaysian holding company to hold a foreign investment as foreign-sourced dividend income including trading profits from a. 457608-K a company authorized as a Certification Authority in Malaysia under Section 8 the Digital Signature Act 1997 and the Digital Signature Regulations 1998.

The key difference between exempt and non-exempt employees is that non-exempt workers are entitled to certain protections under the Fair Labor Standards Act a federal law that sets minimum wage and overtime requirements. Use our branding or your own private label. Ready to raise capital.

And although the FLSA has evolved since its passage in 1938 one thing remains the same employers must classify their employees correctly or. The then Government of Malaysia tabled the first reading of the Bill to repeal GST in Parliament on 31 July 2018. If you offer company cars as a benefit make sure to inform employees how you expect them to behave when using the car and which expenses youll compensate eg.

Complete your investment in as little as 12 minutes 03. The CA 2016 provides for the automatic re-appointment of an auditor for a private company whereas for a public company their appointment is until the conclusion of the companys next AGM. This investment must be.

Similarly to the company car benefit if you offer free parking at the office inform employees how to manage their allocated space. If a US Company pays a dividend to an Indian Resident shareholder then the dividend income will be liable to tax in India. A Labuan trading company is a company established in Labuan Malaysia that carries on certain Labuan trading or non-trading activities.

Malaysias state-owned oil company. On 4 August 2017 the ROC issued Practice Directive 32007. The Goods and Services Tax Bill 2009 was tabled for its first reading at the Dewan Rakyat the lower house of the Malaysian parliament on 16 December.

Banking business 60 D. 2 Notwithstanding subsection 1 the Registrar shall have the power to exempt any private company from the requirement stated in that subsection according to the conditions as determined by the Registrar. Further USA Company paying the dividend also has a right to.

West peninsular Malaysia shares a land border with Thailand and there are two bridges that connect Malaysia to the island of Singapore and has coastlines on the South China Sea and the Straits of Malacca. Available in 7 flavors in High Strength 12MG CBD oil per serving and Mild Strength 45MG CBD oil per serving. High resolution images of your finished tea cans are available at 20 per.

A company is tax resident in Malaysia for a basis year if the management and control is exercised in Malaysia at any time during that basis year. 1 A private company shall appoint an auditor for each financial year of the company. Policybazaar Insurance Brokers Private Limited CIN.

Details of other assets which are regarded as. The 6 tax will replace a sales-and-service tax of between 515. We will work with you to include any information or images that you wish.

However certain assets are regarded as excluded property and are outside the scope of IHT. Deleted 60 C. Exempt car benefits and vehicles that are not cars for FBT.

Companies that are indulged in biotechnology related activities and have an approval as Bionexus Status Company from the Biotechnology Coporation Sdn Bhd Malaysia are eligible. We want to make investing in the private markets as easy as possible. There is a common misconception among business owners and some advisers that certain vehicles are exempt.

6 skinny tins per case. Bahagian Pemodenan Sistem Pengutan BPSP or email to. Pharmaceutical-grade 99 pure cannabidiol.

In fact all you need to do is follow these three steps. An example of excluded property is a non-UK asset owned by non-domiciled individual. Labuan companies enjoy tax advantages with a tax rate of 3 on audited net profits for companies that carry out trading activities and 0 for companies that carry out non-trading activities.

Malaysia is a country in Southeast Asia located partly on a peninsula of the Asian mainland and partly on the northern third of the island of Borneo. APPOINTMENT AUDITORS OF PRIVATE COMPANY. PrivateWhite Label Tea Designs.

WSALE 045 046. Foreign-sourced income received in Malaysia by a resident company other than a resident company carrying on the business of banking insurance shipping or air transport is exempt from tax. 2 Notwithstanding subsection 1 the Registrar shall have the power to exempt any private company from the requirement stated in that subsection according to the conditions as determined by the Registrar.

APPOINTMENT AUDITORS OF PRIVATE COMPANY. Basis period of a person other than a company limited liability partnership trust body or co-operative society 21. Must invest MYR 1 million approximately USD 235000 plus MYR 50000 approximately USD 12000 per dependent spouse or child into a local fixed deposit account.

Purchasing medical insurance from an insurance company in Malaysia. U74999HR2014PTC053454 Registered Office - Plot No119 Sector - 44 Gurgaon - 122001 Haryana Tel no. Takaful business 60 AB.

Unlike capital gains tax where certain assets for example cars are treated as exempt there is no general concept of exempt assets for IHT purposes. In addition under s2553 CA 2016 the ROC may exempt certain classes of companies from appointing an auditor. Get regular updates on how your investment is doing.

Exempt Private Company Timcole Accounting

Exempt Private Company Epc And Its Directors Responsibilities Corporate Services In Malaysia Corporate Advisory Corporate Recovery Restructuring Company Secretary

Private Limited Company In Malaysia All You Need To Know Acclime

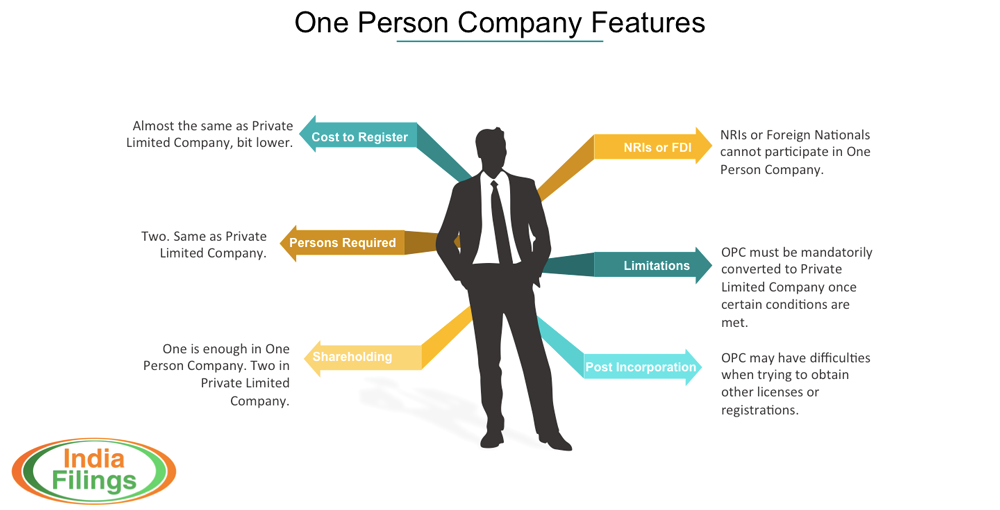

Sole Proprietorship Vs Pte Ltd In Singapore What To Choose

One Person Company Vs Private Limited Company Indiafilings

Ccm Issues Practice Directive On Audit Exemptions For Private Companies Zico

Private Limited Company In Malaysia All You Need To Know Acclime

Audit Exemption For Private Companies Venture Haven Top Malaysia Accounting Firm

A Guide To Investing In Private Companies

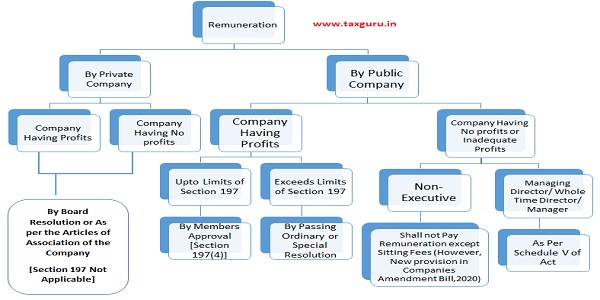

How To Save Tax In Private Limited Company Ebizfiling

Qualifying Criteria For Audit Exemption For Malaysia Private Limited Companies

Ieac International Education Accreditation Commission Biu Human Network Education International Education Online Education

Ccm Issues Practice Directive On Audit Exemptions For Private Companies Zico

Exempt Private Company Epc And Its Directors Responsibilities Corporate Services In Malaysia Corporate Advisory Corporate Recovery Restructuring Company Secretary

Ssm St Partners Plt Chartered Accountants Malaysia Facebook

Classification Of Companies Law Legal Articles By Hhq Law Firm In Kl Malaysia